Whether it’s a credit card, a car loan or a mortgage, credit is a part of life for most adults. You probably know that credit is important, but you’re not alone if you don’t know the differences between good and bad credit.

What is the credit score range in Canada?

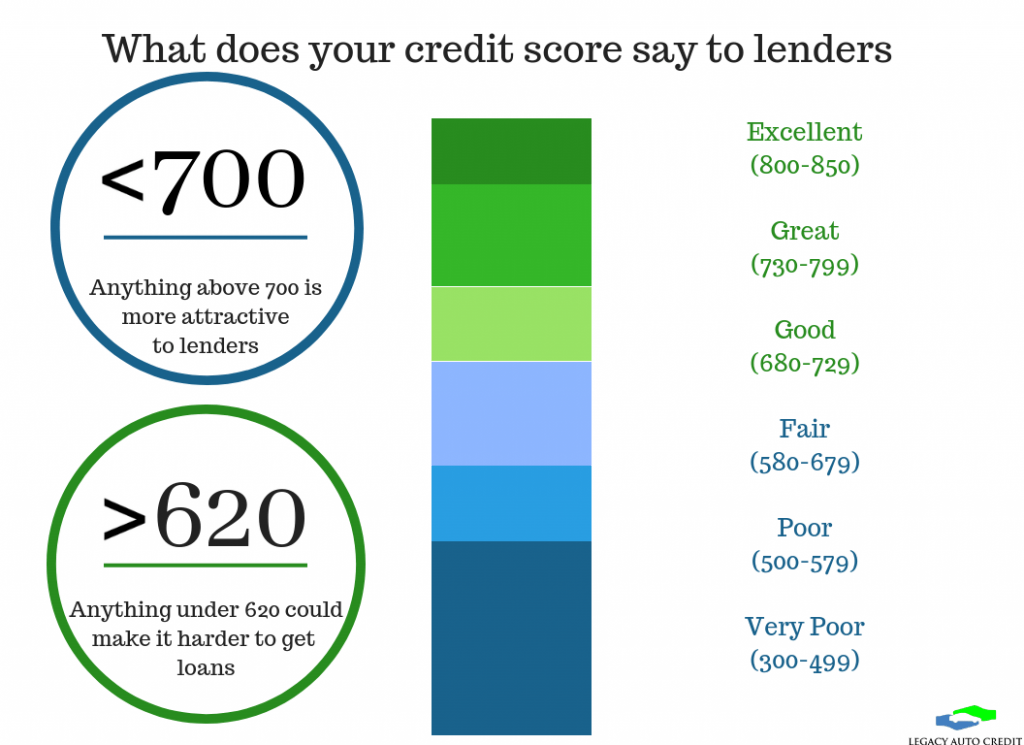

Your credit score is one point on a sliding scale that determines your trustworthiness as a borrower. In Canada, credit scores range from 300 on the low end to 900 on the high end.

If your score is 780 or higher you have excellent credit and will have no trouble getting approved for financing. If your score is 619 or lower you have bad credit.

What does bad credit mean to a lender?

People and companies that lend money need to get back all the money they lend out — otherwise they wouldn’t be in business very long. The credit scoring system gives lenders the ability to see which customers have a good track record of paying back money they borrow.

This system also motivates customers to pay back what they owe in full or risk damaging their reputation as a borrower.

MOST LENDERS APPROACH BAD CREDIT IN TWO WAYS:

- Application rejections: Borrowers with bad credit are seen as a higher risk than those with good credit. Taking on a high risk client doesn’t make good business sense for most lenders.

- High interest rates: Interest is a fee you’re charged to borrow money. If you do get approved for a bad credit loan you’ll end up paying more interest than someone with great credit. This is a safety net for the lender in case the borrower defaults on their loan.

What can I do about bad credit?

Bad credit isn’t a life sentence and there are a lot of things you can do to improve your credit score. Understanding how credit scores are calculated can help you identify ways your can improve your credit habits.

The best tactics for rebuilding your credit score are making all of your payments on time and carrying a low balance. You should also get into the habit of checking your credit report regularly.

How does bad credit happen?

Bad credit is usually the result of risky credit behavior. The national credit bureaus, TransUnion Canada and Equifax Canada, refer to things like late payments, unpaid balances and legal judgements as “ derogatory marks” on your credit report (learn how long bad credit how long bad credit stays on your credit report).

These derogatory marks have a negative effect on your credit history and will lower your score. A single missed payment can stay on your credit report for seven years, even after you’ve taken care of the issue.

Where can I get financing if I have bad credit?

There are options out there for people who have bad credit but need a loan ASAP. If you’re having trouble getting approved for a credit card you can sign up for a secured credit card instead.

Check out our blog post on the best credit cards for bad credit. If you need a car loan look for a reputable dealership that specializes in bed credit car loans and offers in-house financing , like Legacy Auto Credit.

Making sense of bad credit

Bad credit can impact every part of your finances so it’s important to understand how it works. In Canada, any credit score below 619 is considered bad credit. Lenders look at credit scores to determine a customer’s trustworthiness as borrower — a higher score means you have a record of good credit management an a lower score means you have derogatory marks on your credit history.

A bad credit score can make it harder to get approved for financing and result in higher interest rates if you do get approved.

Legacy Auto Credit can secure vehicle financing for customers with bad credit because we look beyond credit scores and take your whole financial situation into account. Give us a call today or fill out an online application to get the ball rolling.